By

Copy URL to Clipboard

Copy URL to Clipboard

If you’re exporting to the United States, then you’ve likely been impacted by the new tariffs they’ve imposed on most goods. . Fortunately, you can avoid these additional costs by taking advantage of preferential tariff treatment under the Tratado entre México, Estados Unidos y Canadá (T-MEC). To do this, you’ll need to fill out a certificate of origin. Here’s what you’ll need to know.

Key takeaways:

The details are more complex than it seems. We’ll guide you through the process so you’ll know exactly how to fill out your document.

Table of Contents

Since March 2025, the U.S. has had a 25% flat rate tariff on goods entering from Mexico. For importers and exporters on both sides of the border that had grown accustomed to nearly duty-free trade between the two nations, it’s been a significant additional expense.

Fortunately, allowances have been made that honor the U.S. and Mexico T-MEC free trade agreement (FTA). Known as the United States-Mexico-Agreement (USMCA) in the United States, it allows for duty-free trade under specific origin rules.

American consumers won’t have to pay expensive tariffs if products enter their country under these conditions. For Mexican manufacturing companies looking to make their products more appealing, this is an opportunity that can’t be passed up.

You’ll have to use T-MEC certificate of origin to show that your goods meet one of four origin criteria.

One of the benefits of T-MEC is that anyone can complete the corresponding certificate of origin. It can either be completed by the exporter, importer, or the certifier of the document.

Typically, the exporter is the one that fills out the document, especially when they know how the goods were produced.

Related: Shipping Produce from Mexico

Your goods must abide by T-MEC/USMCA rules of origin to receive preferential tariff treatment. There are four criteria your goods can meet, and they’re designated by the letters A, B, C, and D.

While certain criteria are easier to meet than others, the one that applies to your goods will vary based on the specifics of your products. Therefore, you should carefully research where your goods were produced and origin of the materials.

If you don’t meet any of the available criterion at this point, you can still use this as a guideline for adjusting your supply chain to become eligible.

Related: How To Ship Freight to Mexico

The T-MEC certificate of origin doesn’t require a specific format. However, it will need specific data elements regarding the goods in question and the participants in the transaction. It’s essential your document is completed correctly, or your goods won’t qualify for preferential tariff treatment.

The first field of your certificate of origin is the certifier section. You’re essentially telling customs authorities who you are as the certifier of the document. You’ll mark yourself as either the exporter, producer, or importer, depending on your role in the transaction.

In this section, you’ll provide all the information about the exporter, importer, and producer. The same details must be provided for each one.

These include:

Customs authorities use this information to verify who is participating in the transaction. They also use it to contact each party in case there’s a problem with the shipment.

Next, you’ll have to provide a product description and HTS classification for the T-MEC goods you want to import or export. Make sure the description of your goods is specific and concise. Customs authorities should be able to read it and reasonably select the HTS number for the commodities.

That said, you’ll still need to provide the appropriate six-digit international HS code for your products. You can also provide the U-specific HTS number to the 8th or 10-digit level as well.

This section is where you will write down the origin that applies to your shipment. There are multiple ways you can state this information.

These include:

Only writing the letter of the origin criteria your goods qualify under is satisfactory, but customs authorities typically prefer the first two methods because of the clarity they provide.

At a time when tariffs are such a delicate issue, it’s better to go with the more detailed format to avoid potential confusion.

If your T-MEC certificate of origin will be used for multiple shipments of identical items for a specified period, you’ll need to provide the applicable start and end dates. Keep in mind, blanket periods can be no longer than 12 months.

It’s essential all the items you export to the U.S. are identical to qualify. Products that don’t meet the origin criteria you’ve already listed would need to have their own documented proof of origin to be eligible for preferential duties.

At the bottom of the certificate of origin, the certifier will authorize the document by providing their signature and the date. They’ll also need to provide other information about themselves, including:

The certificate must include the following statement:

“I certify that the goods described in this document qualify as originating and the information contained in this document is true and accurate. I assume responsibility for proving such representations and agree to maintain and present, upon request or to make available during a verification visit, documentation necessary to support this certification.”

With this section filled out, your T-MEC certificate of origin will be complete.

If you’re going to source raw materials from the U.S. to manufacture in Mexico, you’ll have to find a reliable supplier. There are a few steps you’ll need to follow to secure one.

First, you’ll need to determine the type of material you’ll need to make your goods. Once you identify the material, you can start looking for U.S. suppliers that can provide it. There are a variety of resources that will help you in your search.

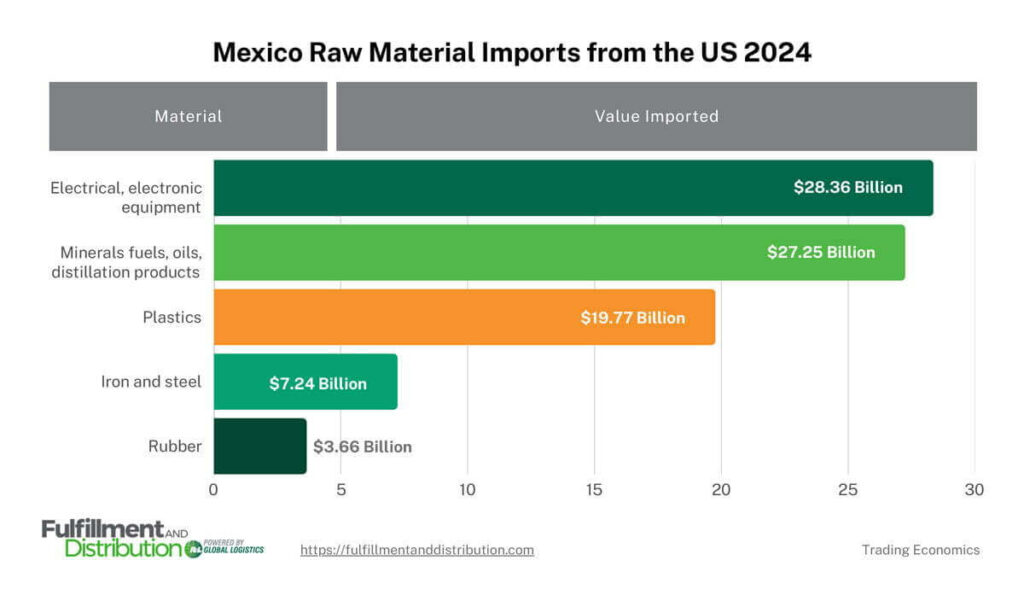

After finding some potential suppliers, look into their credentials and the quality of their materials. This is also a good opportunity to determine if the materials they have meet any of the origin criteria we’ve already discussed. Here’s some data on the top raw materials Mexico imports from the U.S. if you’re not sure what you can source.

Once you’ve selected a supplier, you can start planning out the logistics of your operations. This will involve reviewing T-MEC regulations, finding a customs broker, and booking a carrier. Here at Mexico Cross Border Freight, we have a network of reliable carriers that can move your goods over the border and back again when needed.

Shipping freight back and forth between Mexico and the U.S. has more challenges than ever. With Mexico Cross Border Freight by your side, you’ll have a reliable transportation provider that can move your goods with ease. We have access to a variety of carriers that can provide a number of services for your products.

These include:

Move your goods over the border today by filling out your Mexico Cross Border Freight quote. If you have any questions about our services, then give our team a call at (866) 335-0495 or reach out to us on our contact page.

Copy URL to Clipboard

Copy URL to Clipboard