By

Copy URL to Clipboard

Copy URL to Clipboard

The United States set a precedent for aggressive tariff increases and restructuring of trade agreements in 2025, and Mexico is following suit in 2026. LIGIE tariff reform has impacted the country’s Tarifa de la Ley de los Impuestos Generales de Importación y de Exportación (TIGIE), effective as of 1/1/26. Changes include dramatic tariff rate increases to over a thousand commodity classifications. While importers based in Mexico obviously need to be aware of this reform, the impacts on US importers and exporters are more subtle.

Key Takeaways

In this article, we’ll take a quick look at the tariff timeline for these new levies, which sectors are most heavily impacted, and what importers on both sides of the border can expect as these tariffs take effect.

Table of Contents

On September 9 2025, Mexican President Gloria Sheinbaum introduced a proposal for sweeping customs reforms and tariff rate increases on goods imported from trade partners with whom Mexico does not share a free trade agreement.

Non-tariff reforms in the proposal included:

As far as tariff rates, the proposal called for dramatic increases of 10 to 50% ad valorem on goods across multiple key industrial sectors, notably auto parts, textiles, and base metals in addition to their derived articles.

After an expedited review and negotiation process, many of the reforms and rate increases were approved by Mexico’s congress on December 10 and subsequently published in the Diario Oficial de la Federación on the 29th. These new rules and rates are scheduled for implementation on January 1, 2026.

For importers, the most important aspect of these changes is arguably the tariff rate increases, which I’ll now review in greater detail on a per-commodity basis.

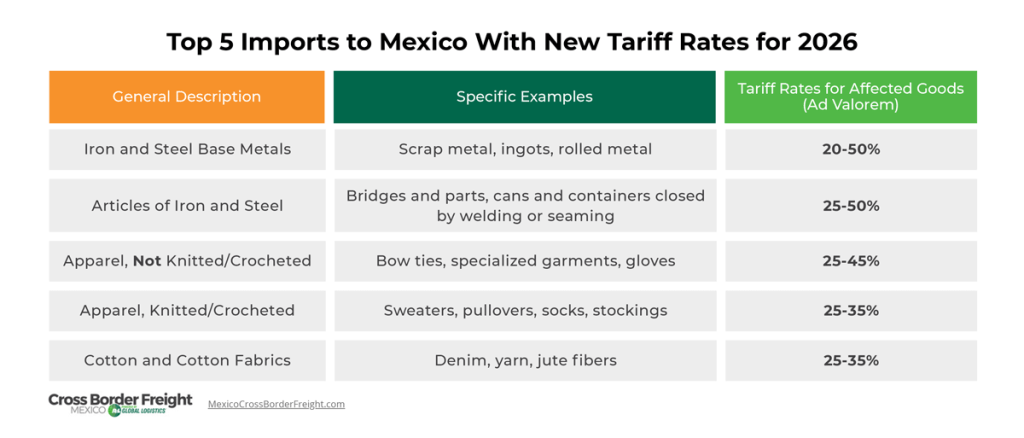

Over 1400 items are impacted by these new tariffs, many of them analogous to IEEPA sectoral tariffs imposed by the United States on its trade partners. The table below lists the most heavily impacted sectors, with specific examples of affected goods and the rates importers in Mexico can expect to pay when sourcing goods from trade partners without an FTA.

Commercial and passenger vehicles also received notable increases of up to 50% from countries without trade agreements. It’s also worth noting that these items, when exported as products of Mexico, are still largely exempt from export taxes.

The effects of these changes, while not completely predictable, can be reasonably inferred from reactions from importers and shippers to increased tariffs in the US throughout 2025.

Importers in the US and Mexico should be prepared for delays in both transit and customs clearance procedures for goods entering and exiting Mexico. Considering the prohibitively high tariff rates on certain countries, importers in Mexico are likely to seek alternative suppliers, which will inevitably lead to shipping delays as resources like trucks and drivers are reallocated to meet changes in shipping patterns.

Similarly, new rules and regulations in customs can easily cause delays in clearance and release of goods. It’s reasonable to expect greater scrutiny than in the past for any import into Mexico claiming preferential duty status, such as those covered in the United States-Mexico-Canada Agreement.

We recommend communicating these potential issues to your customers to set realistic delivery expectations. Don’t wait for the delays to start happening

As an importer in the United States, increased tariffs on imports into Mexico probably won’t impact you directly. However, if your business model includes exporting goods to Mexico either for sale or as part of a manufacturing process, you can anticipate some complications.

One important element of these reforms is greater scrutiny of shipments claiming tariff and duty rates, such as goods that benefit from the United States-Canada-Mexico Agreement (USMCA). This agreement, which is called Tratado entre México, Estados Unidos, y Canadá (T-MEC) south of the border, reduces or eliminates duties and tariffs on many goods traded between the three member nations.

As customs officials in Mexico scale up their efforts to prevent bad actors from falsely reporting goods as duty-free, clearance and release procedures may take longer than they have in the past. Your customers may request assistance with more detailed proof of origin paperwork to avoid delays and inspections on their end.

Related: How To Complete a T-MEC Certificate of Origin

If you’re an importer operating in Mexico, the scope of these changes means you’ll almost certainly be affected by them one way or another.

Firstly, these reforms apply to goods sourced from the world’s number one exporter: China. The Asian economic powerhouse shares no FTA with Mexico, so many shipments from China to Mexico will see substantially higher tariff rates than in previous years.

This means that many importers in Mexico will need to seek alternative sources to avoid paying up to 50% tariffs on their imports. The cumulative impact of multiple importers changing suppliers can also disrupt logistics as shipping patterns are altered by increased demand in different countries of origin.

It’s also worth mentioning that while much of the impact of these reforms can be analogized to the United States’ own trade tactics in 2025, they’re not as likely to be changed or delayed as some proposed US tariffs have been. The reforms were the result of a congressional process rather than an executive mandate, and as such they’re not as easily modified or dismissed as IEEPA tariffs in the US.

Significant changes to customs procedures are often followed by supply chain disruptions as importers make adjustments to maintain profitability and keep their customers happy. By partnering with Mexico Cross Border Freight, you’ll gain access to a wealth of resources and knowledgeable staff who can assist you with shipments going into, coming out of, and moving exclusively within Mexico.

Call us today at (866) 335-0495 or get a risk-free quote for your shipment online. Our experience helping shippers in the US through times of economic turbulence can help you stay ahead of your competition as these new regulations and rates come into play.

Copy URL to Clipboard

Copy URL to Clipboard